RAMS Castle Hill

Details

17/7-9 Barwell Avenue

Castle Hill NSW 2154

Mon to Fri: 9am to 5pm

After hours and weekends by appointment

Introduction

Your home loan is probably your biggest financial commitment. That's why RAMS Castle Hill is committed to making sure your mortgage is made to measure.

Our lending managers are qualified to help you with your property finance, and are available 7 days a week. And if you don't have time to call in to the RAMS Home Loan Centre, don't worry - we're happy to come to you. So why not drop in or give us a call today?

RAMS Castle Hill in the community

RAMS is a national home loan provider with local expertise. And you'll find there's no one better to talk to when it comes to financing property in our local area. We're part of your community; here to serve local people just like you - whatever your situation. So whether you're considering buying your first home, or are ready to purchase again, RAMS can help.

Our home loan offers

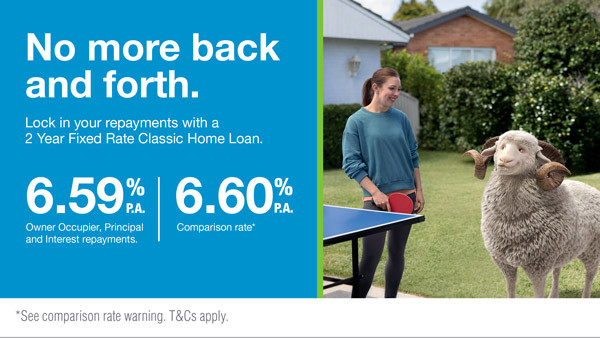

Lock in our low fixed rate

If you're looking for a great rate, look no further with our 1, 2, 3 and 4 year Fixed Rate Classic Home Loan, a basic loan without all the extras.

All offers

RAMS has a range of home loan offers and promotions that could help you into your home sooner.

A RAMS Home Loan Specialist makes a difference

The right home loan for you

A RAMS home loan specialist will find the right home loan to suit you and your stage of life.

Smooth process

Our home loan specialists take the ‘hard’ out of the process for you. They’ll come to you, at a time and place that suits you and sort out approval in days, not weeks, wherever possible.

Personal service

You’ll have a dedicated home loan specialist from start to finish, so you’ll only have to tell your story once. You’ll also have their mobile number, so whatever arises, you can get things sorted.