Units tipped to outpace house price growth in coming years

Australia's housing market is at an 'inflection point' with deteriorating affordability and increased stock causing price growth to moderate, according to a new report.

Units tipped to outpace house price growth in coming years

Australia's housing market is at an 'inflection point' with deteriorating affordability and increased stock causing price growth to moderate, according to a new report.

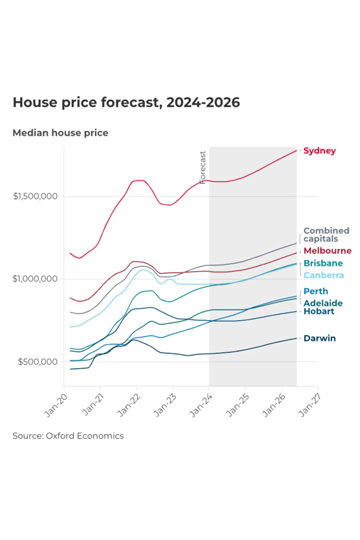

These factors are expected to drive a softer pace of home price growth of 2.7% nationally in 2024 - around half that of the 5.52% annual growth recorded in 2023 - before bouncing back above 6% in 2025 and 2026.

However, affordability constraints could see unit values outpace that of houses over the next few years, while one capital city in particular is set to outperform the rest of the market, according to Oxford Economics.

Picture: Getty

And after years of underperformance, values in the Top End are predicted to rebound.

Capital city forecasts

The Residential Property Prospects report by Oxford Economics Australia, released in January 2024, predicts house prices in Perth will soar by 9.3% in 2024, driven by the city’s relative affordability, strong economy and shortage of housing supply.

The three cities with the fastest price growth last year — Perth, Adelaide and Brisbane — are expected to remain the strongest performing markets in the country.

Oxford Economics senior economist and author of the report, Maree Kilroy, said an imbalance of supply and demand in 2024 will drive persistent strong price growth in the best performing cities of last year.

“Tailwinds will serve to propel prices in Perth, Brisbane, and Adelaide,” she said.

“Low levels of advertised listings and affordability in pockets will prop up prices in these cities next year.”

Western Australia’s rapid population growth and low unemployment rate will boost demand for housing in Perth, the report found, while construction bottlenecks will push buyers towards established houses, which remain in short supply.

Faster price growth in Perth mean the city’s median value is forecast to eclipse that of Adelaide by mid-2025, with house price growth in the South Australian capital tipped to slow to 1% this year.

Adelaide house prices grew by almost 11% in 2023, with growth driven by a combination of affordability compared to the east coast capitals, combined and a limited supply of homes.

Brisbane is forecast to record the second-fastest house price growth behind Perth, with values expected to jump 3.9% in 2024.

“The Brisbane market continues to benefit from relative affordability compared to the southern capitals, alongside strong future employment prospects, demand fuelled by interstate and overseas migration, and a scarcity of new dwelling supply,” Ms Kilroy said.

By contrast, worsening affordability will soften demand in Sydney — Australia’s most expensive city, where home prices jumped 7.72% last year — as will rising listing volumes, Ms Kilroy said, resulting in house price growth of just 1% in 2024.

Picture: Getty

Prices in Melbourne are expected to remain relatively flat with 0.7% growth in 2024, with increasing supply and policy changes affecting property investors keeping a lid on growth. However, price growth is expected to accelerate in the following years.

“Rising total listings have provided greater options for buyers in Melbourne, reducing urgency to purchase, in turn leading to easing conditions,” Ms Kilroy said.

“Slower growth in the upper quartile has become increasingly evident, hinting that, as affordability worsens, demand is being deflected from the more expensive price bracket to the middle of the market.”

While growth is expected to slow across the capitals, one city is forecast to make a comeback after several years of underperformance.

Ms Kilroy expects house price growth in Darwin to accelerate from mid-2024 onwards, with values jumping 7% in FY25 and 8.2% in FY26, with government investment driving employment growth.

Picture: Getty

Darwin's median house value fell 1.58% in 2023, according to the PropTrack Home Price Index, and values haven't yet recovered since the 2022 downturn.

More than $6 billion is slated to be spent on defence projects in the Northern Territory in the next few years, creating about 7500 new jobs, and the boost to the economy is expected to benefit the territory's housing market.

Units tipped to outpace house price growth

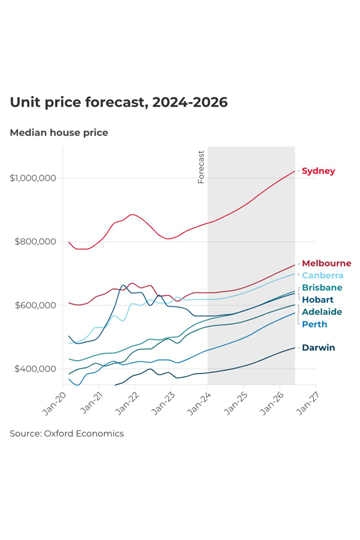

Although house price growth across the combined capitals is expected to remain relatively subdued at 2.1% in 2024, unit prices are forecast to grow faster at 4.6%.

Units are forecast to outpace houses in Sydney (6%), Brisbane (5.1%), Adelaide (3%), and Melbourne (2%), and while unit prices are expected to jump 8.5% in Perth, house price are still forecast to grow at a faster rate.

Nationally, unit prices are expected to accelerate to 7.6% growth in both FY25 and FY26, led by Perth where unit values are tipped to grow by 9.7% per annum, Sydney (8.3% p.a.), Brisbane (8.2% p.a.) and Darwin (8% p.a.).

The cheaper price of units compared to houses is expected to drive growth, given high property prices and high interest rates have made buying a home increasingly unaffordable.

Houses outperformed units in most capitals last year, and have posted stronger growth since the pandemic, when buyer preferences shifted towards larger, detached properties.

With significantly reduced borrowing capacities, units may be a more attractive option to buyers with less to spend, given the national median unit price is almost $200,000 cheaper than the house median, and more than $500,000 cheaper in Sydney.

Upgraders and high-income earners to keep prices elevated

The latest PropTrack Property Market Outlook Report also predicts slower growth across Australia in 2024, despite a continuation of the trends that pushed prices higher last year in most cities.

PropTrack director of economic research and report author Cameron Kusher said higher mortgage and living costs, rising unemployment and the potential for more stock coming to market could curb the runaway growth of 2023.

“The national housing market appears likely to see lower price growth in 2024 compared to the surprisingly strong growth in 2023,” he said.

Picture: Andrew Parliaros

But despite slower growth than last year, a number of factors could cause higher priced properties to increase in value in 2024.

“Over the second-half of the year the market may see a boost from the implementation of stage three tax cuts,” Mr Kusher said.

The tax break, which will increase the take-home pay of higher income earners, could lift home buying budgets, especially for upgraders taking advantage of large equity boosts since the pandemic boom.

Additionally, the share of buyers with large deposits has almost doubled since the middle of the pandemic, and given these buyers are more insulated from higher interest rates, increased upgrading activity could help keep prices elevated.

This article was originally published on realestate.com.au ‘Unit prices forecast to outpace houses in coming years’