A historic year for housing: 10 property market records set in 2021

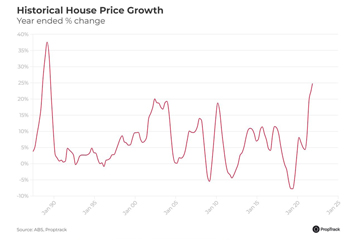

In 2021, strong demand, low supply and low interest rates combined to drive the fastest pace of price growth in more than three decades.

A historic year for housing: 10 property market records set in 2021

In 2021, strong demand, low supply and low interest rates combined to drive the fastest pace of price growth in more than three decades.

Price growth, views per listing, days on site and preliminary weekly sales volumes all broke records, while the number of suburbs in the $3-million club tripled.

Below we count down the property records set in the year that was…

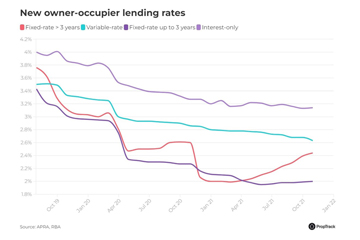

10. Mortgage rates hit historic lows

Low interest rates and near-zero real mortgage rates spurred record demand for property, pushing prices higher Australia wide. Home lending growth gathered pace, and new lending and refinancing drove total housing finance commitments to an all-time high.

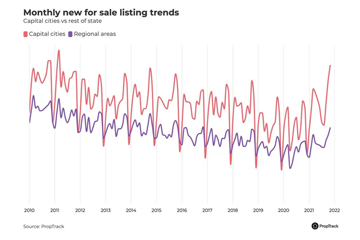

9. Listings hit historic lows

Earlier in the year active (total) for sale listings on realestate.com.au hit an historic low after falling 3.3% in June 2021.

However, as lockdowns lifted, the yearend has brought three consecutive months of increased listings, with November bringing decade highs for new listings in capital cities.

8. Demand hit record highs

Low rates, shifting lifestyle preferences, an influx of expats, low supply of properties for sale, forced savings and government support measures all fuelled Australia’s appetite for property, pushing prices to new highs.

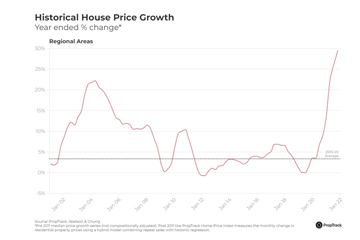

7. Prices rose at the fastest pace in more than three decades

In the year to November, dwelling prices rose 23% in capital cities and surged by 30% in the regions. The price growth was the fastest in more than three decades.

Sydney remained the most expensive market by a long shot, but across the country seven-figure searches were popular and the share of searches for properties priced at or above $1 million was at a record high.

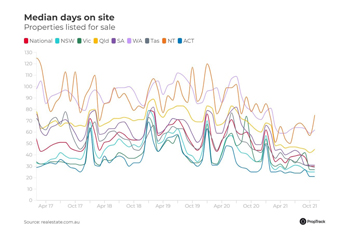

6. Properties sold at record speed

Buyers faced tough competition with the supply of properties for sale at low levels, many were forced to make quick decisions.

In November, the median number of days a property was listed on realestate.com.au before selling was at an historic low of 30 days.

2021 was well and truly a “sellers’ market”, and though buyers continue to outweigh sellers, there are signs that balance may be slowly shifting.

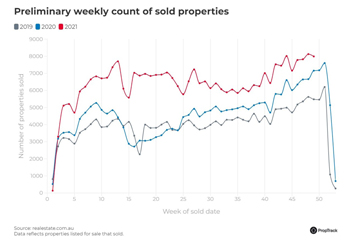

5. Sales volumes soared

Sales volumes hit record highs for much of this year. In the first weeks of December, sales volumes clocked the 8,000 mark for the first time, according to PropTrack data.

4. Demand for luxury property soared

Lockdowns were no match for demand for luxury property. Australia’s $3-million suburb club doubled again in 2021, as surging household wealth, strong savings and low rates allowed many to take on more debt, pushing house prices higher.

Closed international borders and more time at home saw some re-assessing their housing needs, with Australians and returning expats opting for lifestyle and wellbeing upgrades. As a result, demand for lifestyle and coastal properties surged.

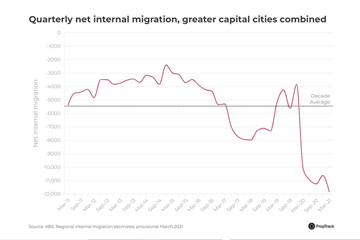

3. Capital cities clocked a record net loss of people

In the March quarter of 2021, data from the ABS showed capital cities recorded a net loss of 11,800 people – more than double the decade average and the largest quarterly loss on record.

Taking advantage of remote working, many opted for that sea or tree change, with a net 43,000 people exiting capital cities in favour of regional areas - the biggest net influx to the regions since Australian Bureau of Statistics (ABS) records began in 2001.

2. Demand for regional property soared

With both net regional and interstate migration trending, the regions saw record price growth. Combined regional housing markets outperformed combined capital cities in terms of price growth.

Regional markets were the standout as a unique combination of circumstances supersized demand for regional locations.

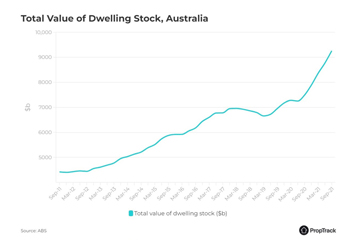

1. Australian housing value hits a record $9 trillion

The forces outlined above have resulted in the value of Australian homes (and the wealth of homeowners) surging in 2021.

Data from the ABS shows the total value of Australia’s housing stock hit an all-time high of $9.26 trillion.

Not only have government support measures provided an exceptional buffer to households, but the increase in the value of non-financial assets, housing, and non-monetary financial assets, equities, has been equally as formidable. In addition, the household saving ratio increased to 19.8% from 11.8% in the June quarter – a sizeable cushion in the event of continued disruption.

According to the ABS, total household wealth (net worth) rose by $590 billion, or 4.4%, hitting an all-time high $13.92 trillion in the September quarter. That’s up 20.2% on a year ago – the largest annual gain in more than a decade.

With the labour market recovering quickly and the economy rebounding, this wealth effect should continue to drive a strong economic recovery. In property, with many current homeowners having accumulated substantial equity gains, this should support upgraders and transactional volumes in 2022.

Though the pace of price growth in 2022 will be no match for 2021’s record-breaking speeds.

This article was originally posted on realestate.com.au as ‘An historic year for housing: 10 property market records set in 2021’