RAMS Chatswood

Details

Shop 8, 18- 26 Anderson Street

Chatswood NSW 2067

Mon to Fri: 9am to 5pm

After hours and weekends by appointment

A mortgage made to measure

Our lending managers are qualified to help you with your property finance, and are available 7 days a week. And if you don't have time to call in to the RAMS Home Loan Centre, don't worry - we're happy to come to you. So why not drop in or give us a call today?

Introduction

Your home loan is probably your biggest financial commitment. That’s why RAMS Chatswood is committed to making sure your mortgage is made to measure. Bring your whole family as we have a TV room to keep the kids occupied! Enjoy hot coffee or chilled spring water while your application is being completed. We are located on the corner of Help and Anderson Street, opposite St Pius X College. Parking is available 2 hours free (request validation at our office) in the Regency building.

RAMS Chatswood in the community

We have a team of experienced lending Professionals who have had many years of experience in providing home loans and serving the area. Our Manager, Richard Lee, also speaks Cantonese to serve the needs of the local Chinese community. We will go that extra Mile to ensure you achieve your goals, or 100 Miles if we have to!

Our home loan offers

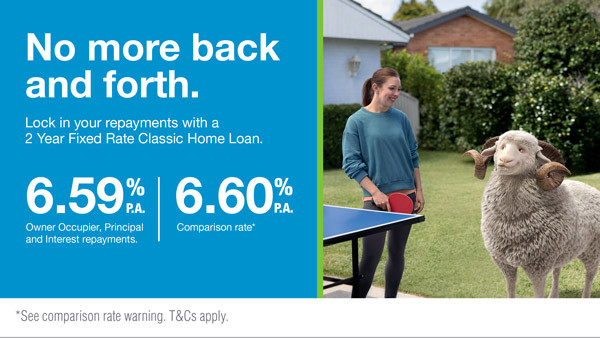

Lock in our low fixed rate

If you're looking for a great rate, look no further with our 1, 2, 3 and 4 year Fixed Rate Classic Home Loan, a basic loan without all the extras.

All offers

RAMS has a range of home loan offers and promotions that could help you into your home sooner.

A RAMS Home Loan Specialist makes a difference

The right home loan for you

A RAMS home loan specialist will find the right home loan to suit you and your stage of life.

Smooth process

Our home loan specialists take the ‘hard’ out of the process for you. They’ll come to you, at a time and place that suits you and sort out approval in days, not weeks, wherever possible.

Personal service

You’ll have a dedicated home loan specialist from start to finish, so you’ll only have to tell your story once. You’ll also have their mobile number, so whatever arises, you can get things sorted.